Market

By Christopher M. Uhl

Kamala Harris’s recent choice to skip Joe Rogan’s podcast has people talking. Rogan’s platform has massive reach, and after Donald Trump’s episode drew over 37 million views, it’s clear that showing up can create huge momentum. Harris’s campaign, however, didn’t want to risk an unfiltered, unscripted chat that could go anywhere. Critics feel Harris may have missed a prime chance to connect with Rogan’s audience—young, politically curious, and often skeptical of mainstream media. Could this cost her in the 2024 race? Many think so, as Rogan’s listeners could have been a perfect crowd to engage.

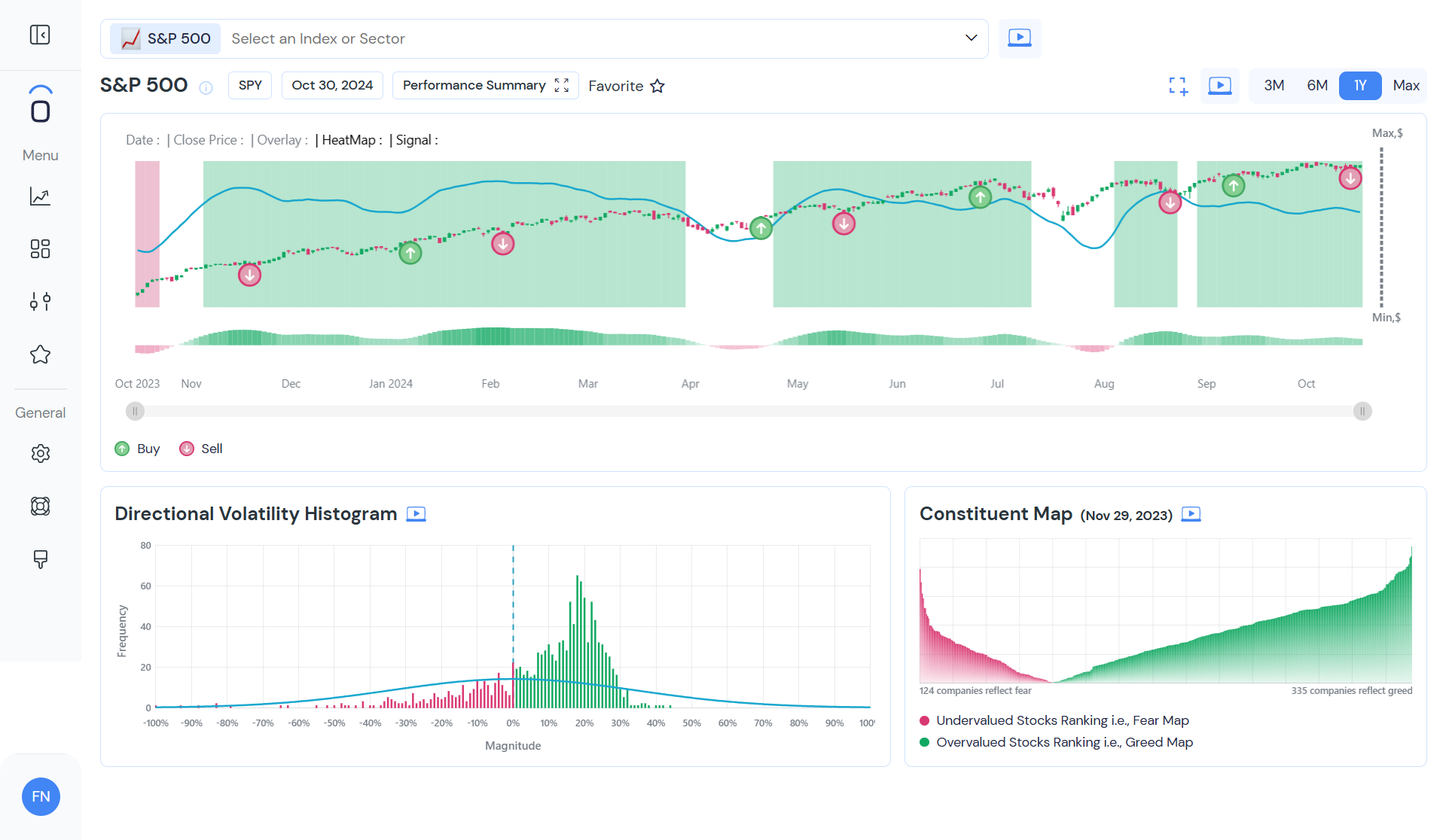

Now, shifting to the stock market, the SPY ETF, which mirrors the S&P 500, recently triggered a sell signal, leaving traders wondering what’s next. A sell signal in a bullish market isn’t a panic button but more of a “pause and cash out” suggestion. SPY has been closing in on all-time highs, so locking in some gains at this point might be wise. However, this signal doesn’t necessarily mean it’s time to short SPY. With major indices still showing strength, it’s more of a cue to stay cautious and wait for the market to show a clearer direction.

The overall approach here? It’s about playing it smart: capture the highs, take a breather, and prepare for whatever’s next. With the market’s current mix of bullish signals and a few cautious sell flags, traders are balancing gains with a healthy level of restraint. For anyone following SPY, it’s all about making the most of the uptrend while staying ready for possible twists—because in both markets and politics, momentum can shift fast.