Market

By Christopher M. Uhl

Ever wondered how pro traders size their trades without blowing up their accounts? It’s all about understanding volatility and using something called the Average True Range (ATR). Sounds fancy, but it’s actually pretty simple.

ATR basically tells you how much a stock typically moves in a day. When things are calm, the ATR is lower. When the market’s going wild, the ATR shoots up. The trick is to adjust your trade size based on how wild the market is. More volatility? Smaller trades. Less volatility? You can go bigger.

Here’s how it works: Let’s say you’ve got $5,000 to risk on a trade, and the stock’s ATR is 1.5. Instead of just guessing how many shares to buy, you use the ATR to figure it out. When volatility is high, you shrink your position so you’re not risking too much.

During crazy times, like the COVID crash, some stocks’ ATR went up by 5x! If you didn’t adjust your trade size, you’d be in for a wild ride (and not the fun kind). So, by using the ATR, you keep things steady and avoid nasty surprises.

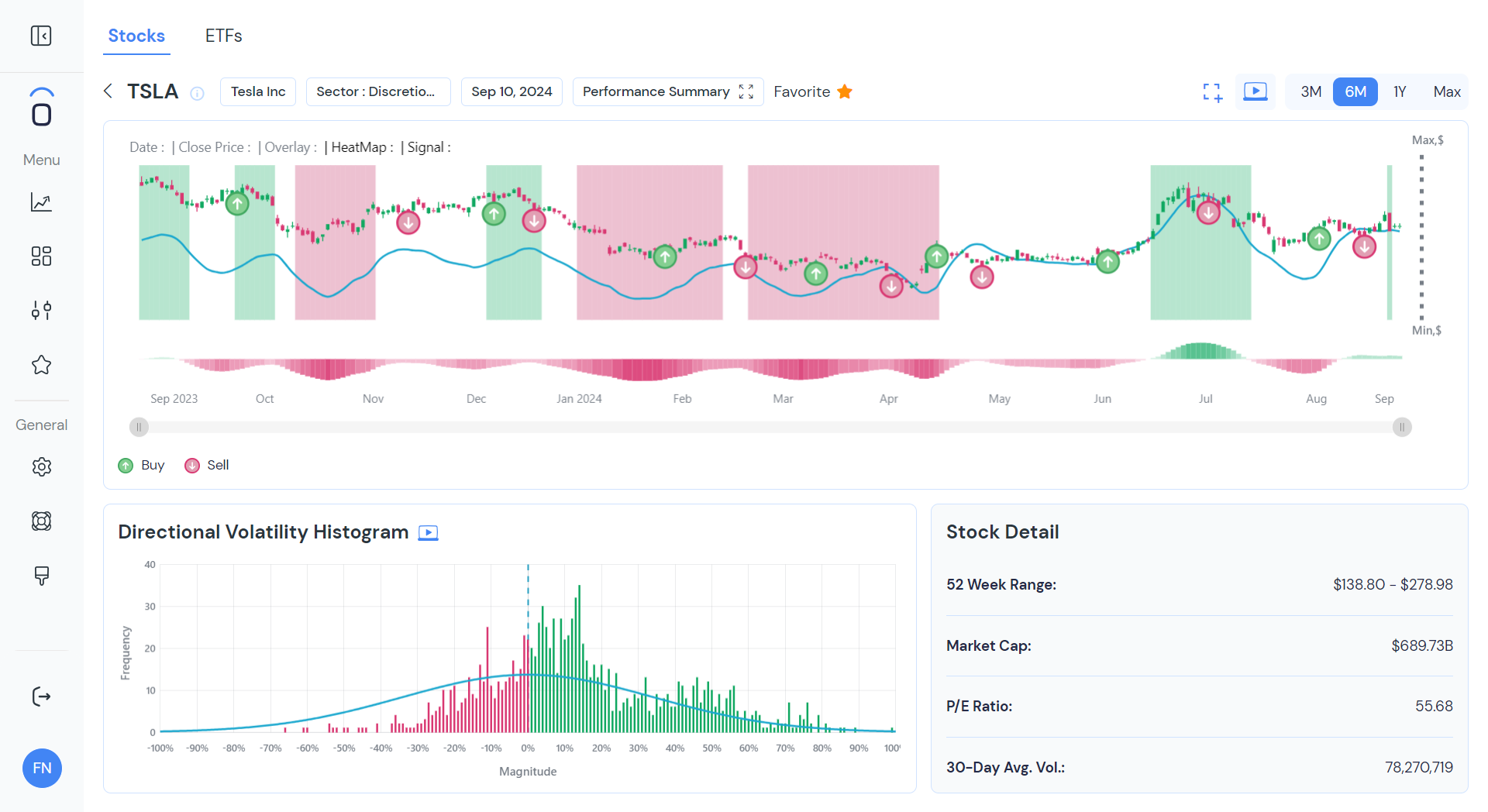

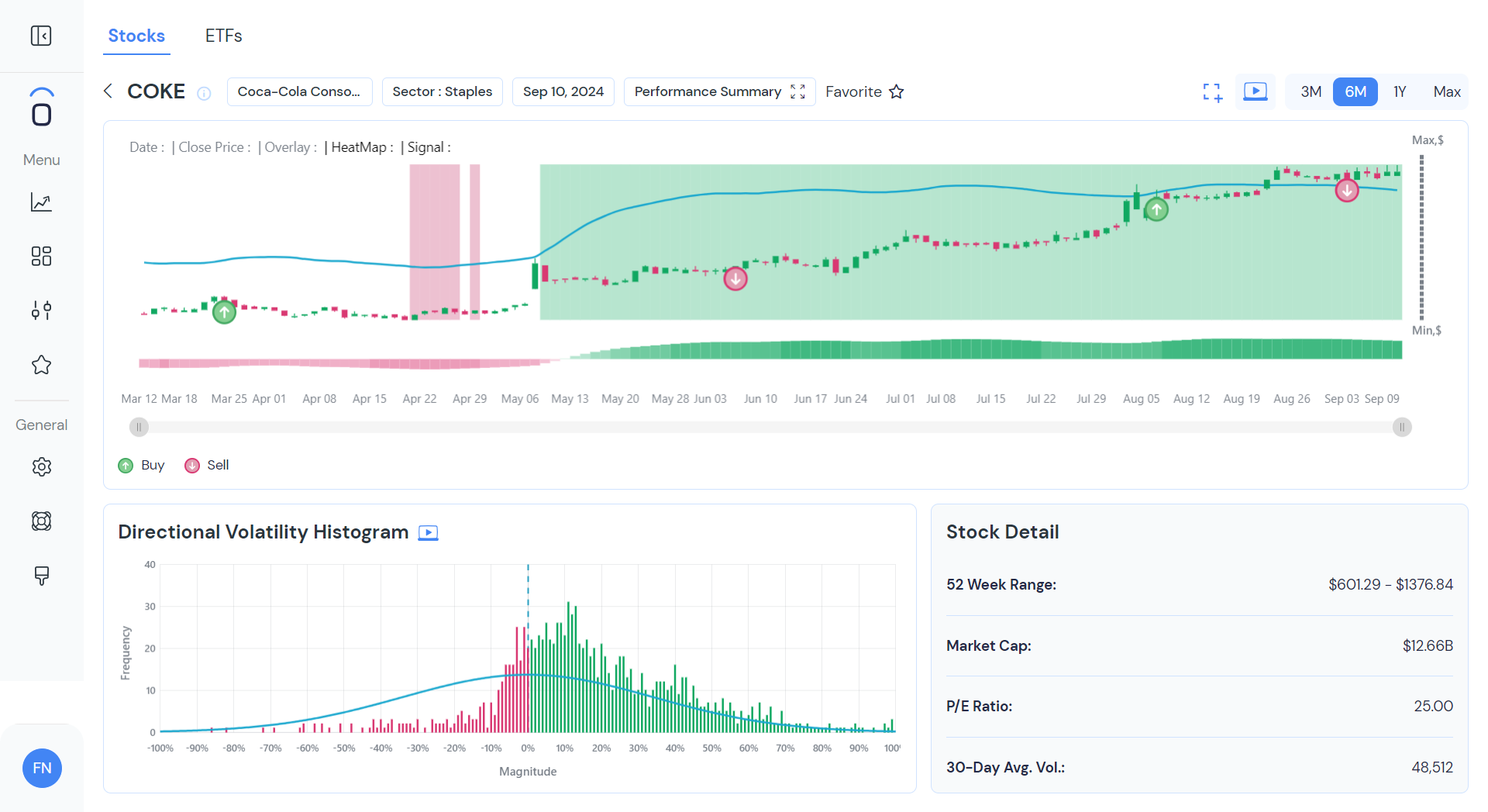

Here’s an example: Tesla and Coca-Cola have super different ATRs. Tesla’s a wild child with big swings, so you’d buy fewer shares. Coke? Pretty chill. You can buy more without stressing too much. Even if you’re risking the same amount of money on both, the number of shares changes because of their volatility.

Bottom line: Don’t just YOLO into trades with random sizes. Use the ATR, adjust for volatility, and trade like a pro.