Market

By Christopher M. Uhl

Fed Days are always a big deal for traders. Some love them, and some avoid them entirely. Why? Because a lot can happen with these announcements. Take today for example: the market barely moved, but there was a moment of massive volume that shot the charts up, only to fall back down and go sideways. If you managed to catch that minute-long move up and down, you could’ve made a killing. I didn’t, but I’d love to hear if anyone did!

The big news today? A half-point interest rate cut. It’s a move the Federal Reserve made to combat inflation, and it wasn’t without debate. Not everyone agreed on the size of the cut, but it happened. Now, the Fed is signaling more rate cuts to come. If you’re trading, keep an eye on these. The Fed’s decisions can lead to either big gains or frustrating losses, depending on how you play them.

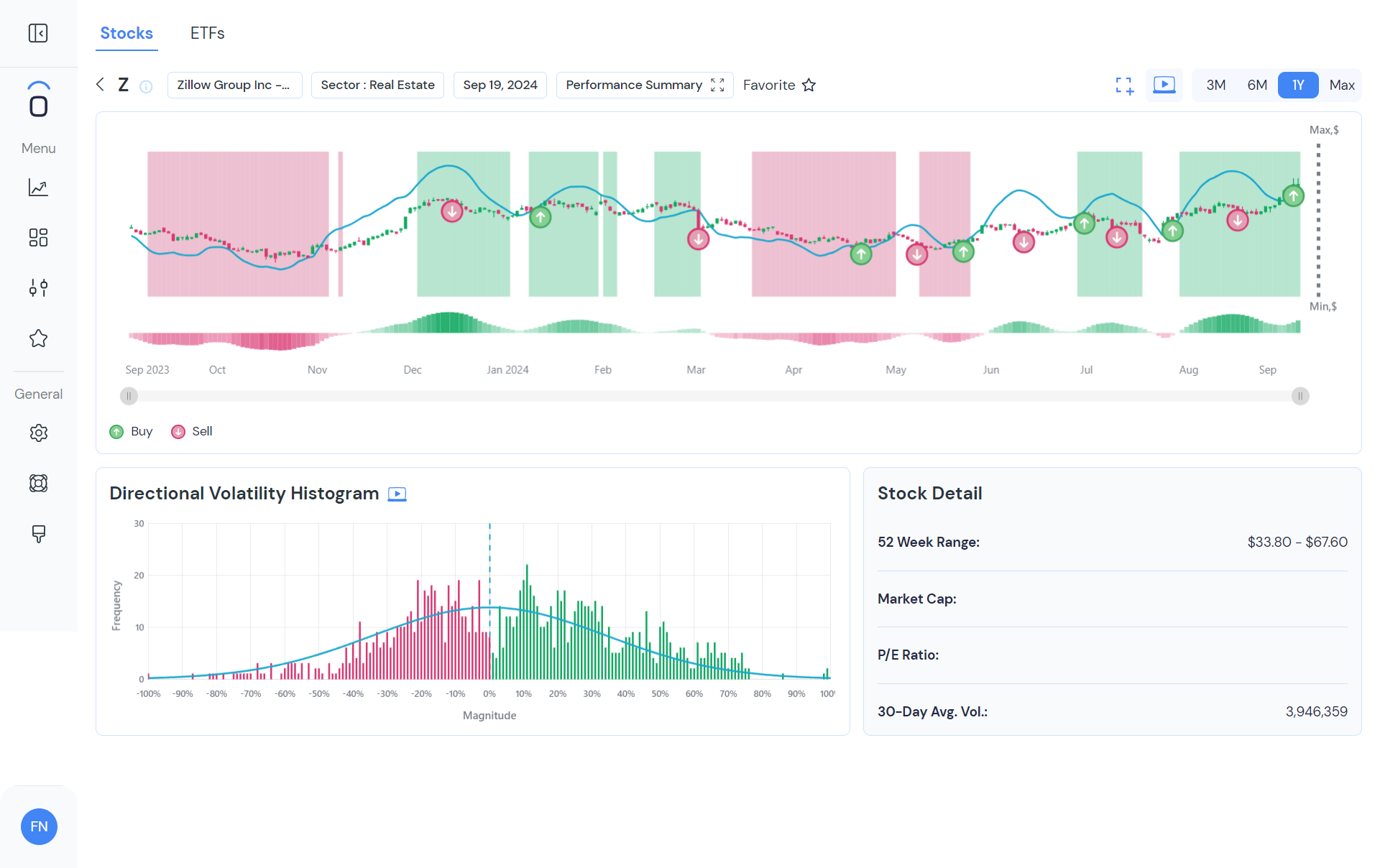

Speaking of today’s movers, let’s talk about Zillow. It had a nearly 5% spike—definitely one to watch! It was on our buy list this morning, and it didn’t disappoint. We saw Zillow’s stock shoot up right before the Fed’s announcement. If you caught it, you’d be sitting pretty right now.

But here’s the kicker: It’s not all about getting lucky with these moves. Reducing risk is key. Before you throw on any new trades, take a step back and think about how you can cut down on risk first. Look at your current positions—are there any that need to be closed out to protect your profits? Or maybe you’ve got a loss that’s been dragging down your account. Closing that position might be the best move before it gets worse.

Remember, position sizing is everything. If you’re going too big on one trade, you’re exposing yourself to way more risk than necessary. By sizing your positions based on the stock’s volatility, you can ride the waves without stressing over every tiny dip.

In the end, smart trading is all about balance. Get in when it makes sense, get out when the signs point that way, and always keep your risk in check. And of course, always be learning from your wins—and your losses!