Market

By Christopher M. Uhl

Big news is on the way for OVTLYR, and it’s creating a buzz. Although the exact details are still under wraps, there’s a lot of anticipation about how this will get OVTLYR into more hands.

In the trading world, things are looking pretty positive right now. The SPY is giving a clear buy signal, with the 10-day moving average above the 20-day average and the price sitting comfortably above the 50-day average. Market breadth is strong, with most sectors performing well, except for utilities. Even though utilities aren't doing as well, the overall trend is still upbeat.

Trades are showing promise too. Recently, the SPY has climbed 10% from its lows. The game plan is to keep an eye on market conditions and adjust trades to manage risk effectively. For instance, Walmart is currently being reviewed using a trading technique known as rolling. This technique lets traders tweak positions to lock in some gains while keeping the trade open, which is useful as market conditions shift.

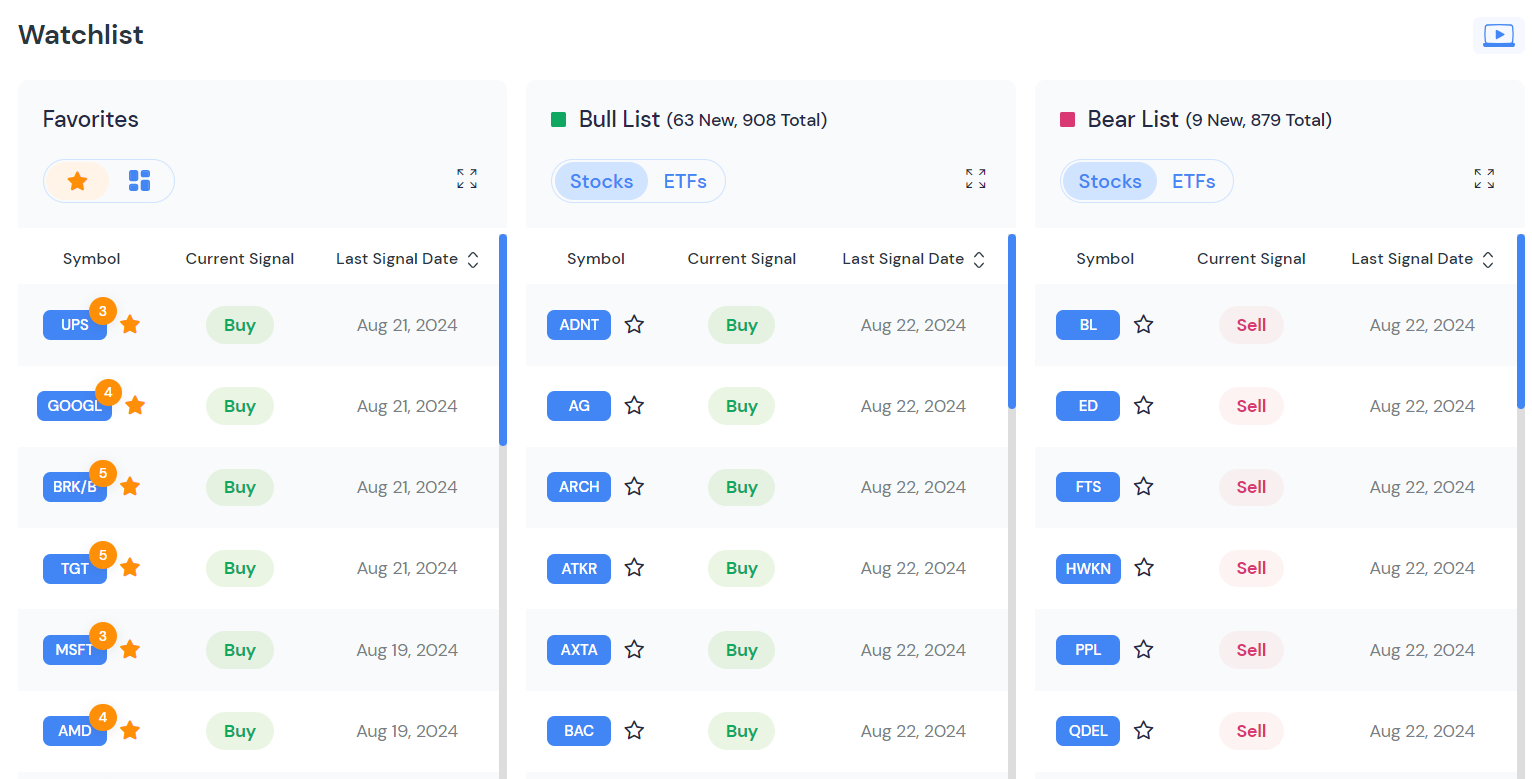

Looking ahead, new trades are being eyed, especially those with a solid track record and positive signals. Stocks like XLB, CTRE, and Roll are on the radar. XLB, the materials ETF, is trending well and has good liquidity. CTRE is another potential pick, but it’s crucial to check the latest info to ensure it’s still a solid choice. The screening process helps narrow down stocks to the best opportunities.

So, the strategy is to stay optimistic, manage trades smartly, and zero in on high-potential stocks. By keeping up with market trends, using smart trading methods, and adjusting positions as needed, there’s a good chance of making the most of the opportunities while keeping risks in check.