Behavioral Finance

By Christopher M. Uhl

Hey there, folks! Let's talk about something that's been on everyone's minds lately: rising prices. You know the drill—Biden's ex-chief of staff spilled the beans, admitting that prices in the U.S. are sky-high. But let's be real, did we really need an insider to tell us that?

I mean, take a quick look at your grocery bill and you'll see what I'm talking about. It's like a game of "how high can it go?" every time you hit the checkout counter. And don't even get me started on gas prices—they're enough to make you want to start biking everywhere.

But here's the kicker: while they're trying to spin this yarn about inflation being under control, the reality paints a different picture. Sure, they throw around fancy terms like "disinflation," but let's call a spade a spade—prices are still climbing, folks.

And who's feeling the heat the most? Surprise, surprise—it's us regular folks. You know, the ones who don't have a yacht parked in the backyard or a personal caviar stash. We're the ones scraping by, trying to make ends meet while the powers that be play economic gymnastics.

It's not just about the numbers on a report—it's about what we see when we open our wallets. And let me tell you, it's not a pretty sight. From skyrocketing grocery bills to eye-watering gas prices, it feels like we're getting pinched at every turn.

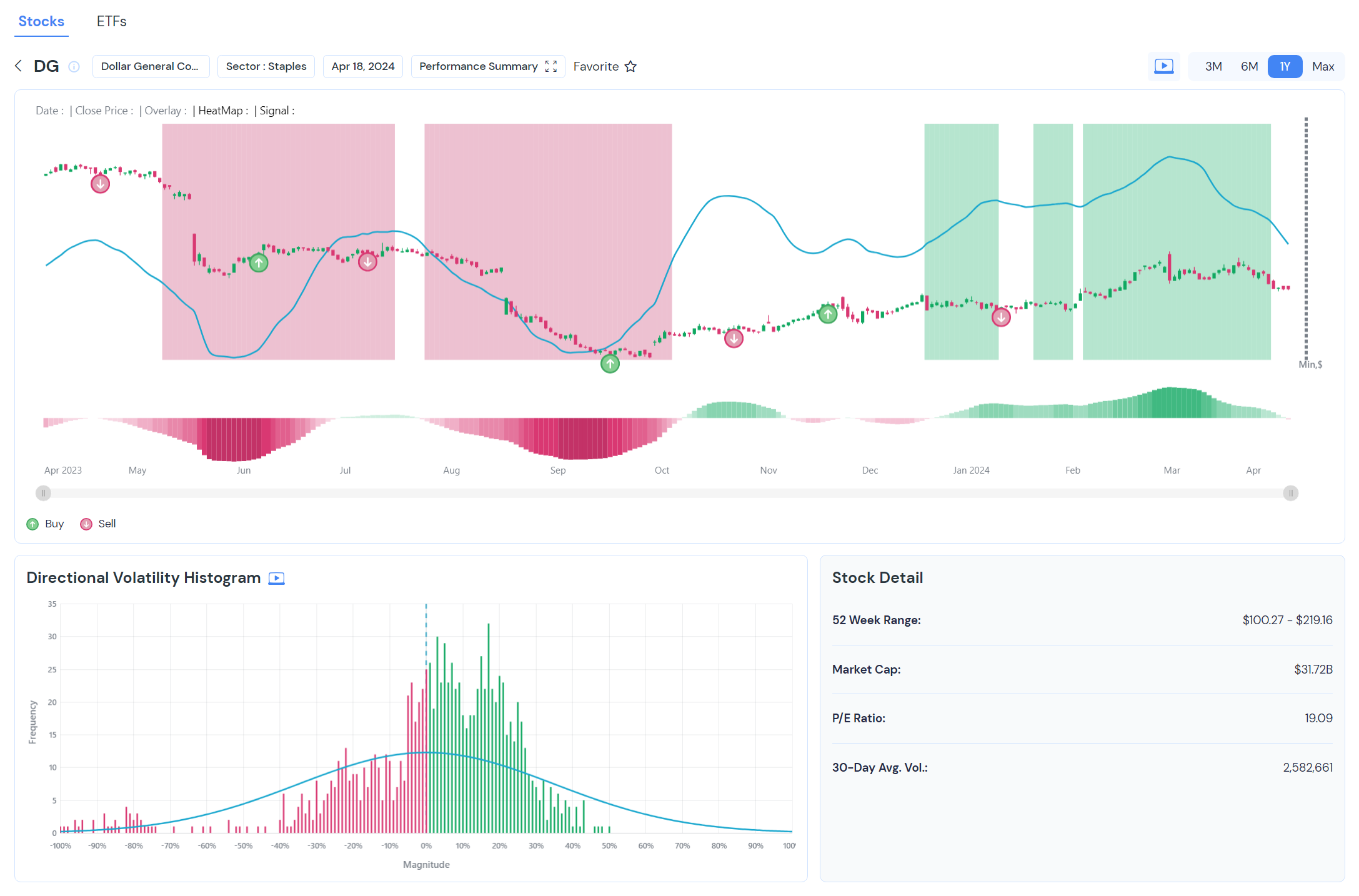

And hey, let's not forget about Dollar General. If even they're feeling the squeeze, you know it's bad. It's like a canary in the coal mine for the rest of us budget-conscious folks.

So, where does that leave us? Well, it's time to call a spade a spade and stop pretending like everything's peachy keen. We need real solutions, not sugar-coated spin. Because at the end of the day, it's our wallets—and our livelihoods—that are on the line.