Market

By Christopher M. Uhl

If you’re into trading, you’ve probably heard of order blocks. But what if I told you they’re like having a cheat code? Seriously, they’re that powerful. Here’s why.

Order blocks are basically areas on a chart where big players (think institutions) have left huge buy or sell orders. Until those orders are fully filled, these areas create strong support or resistance zones. Imagine a price trying to break through a wall—that’s an order block doing its job.

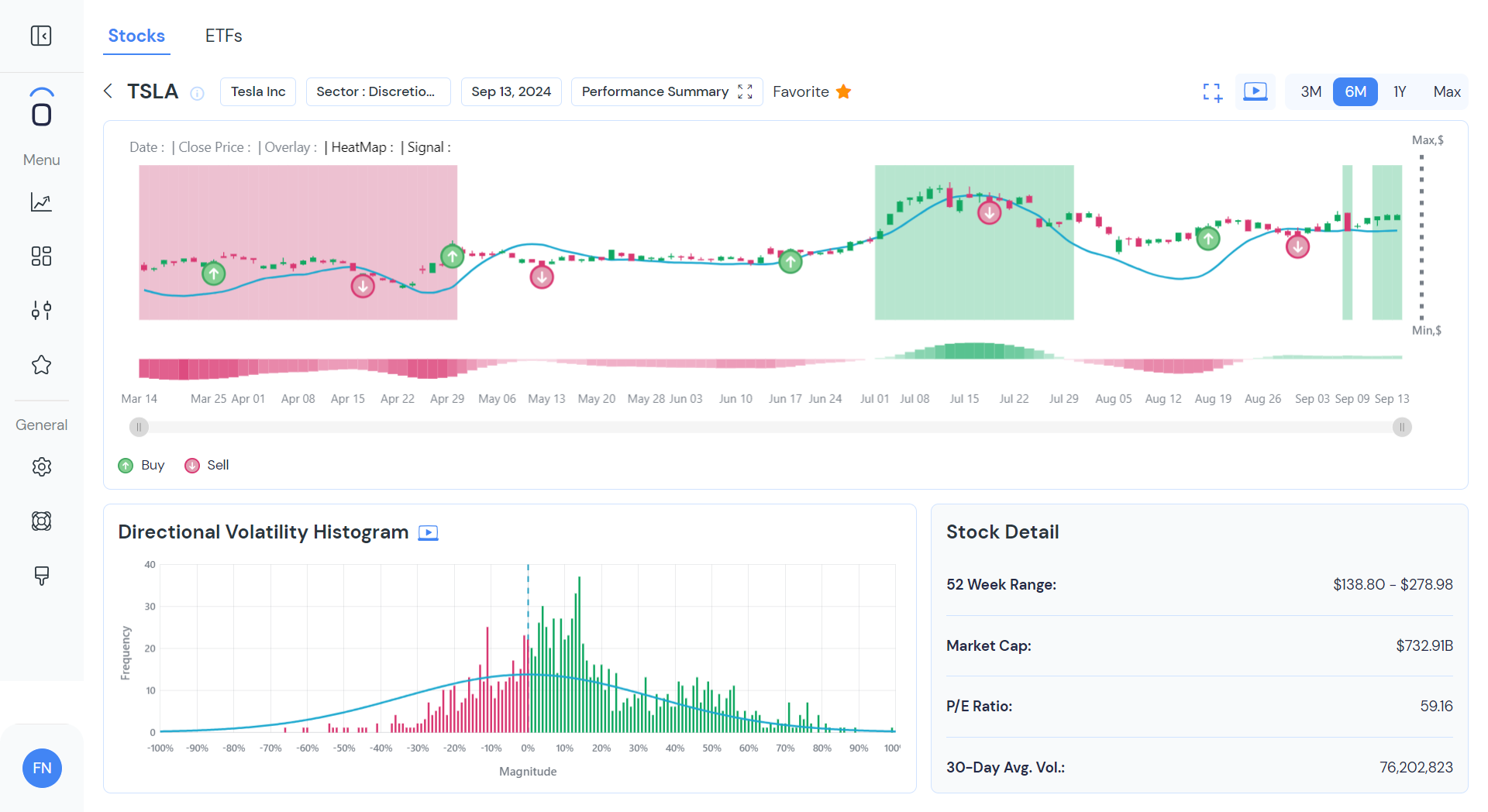

For example, look at Tesla. In a recent analysis, we saw multiple order blocks hovering right above Tesla’s price, creating massive resistance. Every time Tesla’s price tried to break through these blocks, it got rejected, and the price dropped back down. This is a perfect illustration of how order blocks can work as glass ceilings, making it difficult for prices to move past a certain level.

What makes order blocks so cool is their predictability. Once you know where these blocks are, you can plan your trades accordingly. No more guessing if the price is going to keep going up or down—you can just let the order blocks tell you what’s likely to happen next. If the price is heading into a sell block, you might want to avoid going long. And if it’s nearing a buy block, maybe don’t go short. Simple, right?

By using order blocks, you’re trading smarter, not harder. They’re like little cheat codes that give you a heads-up on what might happen next. Whether you’re bullish or bearish, adding these blocks to your charts can make a big difference in your trading strategy. Plus, it feels pretty awesome to know you’re working with the same data as the big institutions.

So, want to up your trading game? Order blocks might just be the edge you’ve been looking for.